Not known Details About Hard Money Atlanta

Wiki Article

Hard Money Atlanta Things To Know Before You Buy

Table of ContentsThe smart Trick of Hard Money Atlanta That Nobody is DiscussingOur Hard Money Atlanta PDFsLittle Known Questions About Hard Money Atlanta.What Does Hard Money Atlanta Do?Facts About Hard Money Atlanta Uncovered

, are temporary lending instruments that real estate investors can use to finance an investment job.There are two main disadvantages to consider: Hard money financings are hassle-free, yet capitalists pay a rate for obtaining this means. The price can be approximately 10 portion points more than for a standard loan. Source charges, loan-servicing costs, and shutting prices are additionally most likely to set you back financiers much more.

All about Hard Money Atlanta

Again, lenders may permit financiers a little bit of freedom here.

Tough money loans are an excellent fit for well-off financiers that require to obtain funding for a financial investment home swiftly, without any of the red tape that accompanies bank financing (hard money atlanta). When reviewing hard cash lenders, pay very close attention to the charges, passion rates, as well as car loan terms. If you wind up paying excessive for a hard money finance or cut the repayment period also brief, that can affect how rewarding your actual estate endeavor remains in the future.

If you're wanting to acquire a house to flip or as a rental building, it can be testing to get a standard home mortgage - hard money atlanta. If your credit report isn't where a traditional lending institution would like it or you require cash faster than a loan provider is able to supply it, you can be unfortunate.

Hard Money Atlanta for Beginners

Tough money financings are temporary protected car loans that make use of the residential property you're purchasing as security. You won't find one from your bank: Hard cash car loans are offered by alternate lending institutions such as individual investors and personal business, who commonly overlook average credit report and various other economic variables and also instead base their decision on the property to be collateralized.Hard money financings give a number of advantages for debtors. These consist of: From begin to complete, a hard money loan could take just a couple of days.

It's vital to consider all the hazards they reveal. While tough cash lendings included advantages, a consumer needs to additionally consider the risks. Among them are: Hard money loan providers normally bill a higher rates of interest due to the fact that they're thinking more danger than a typical lender would. Once again, that's as a result of the threat that a tough money loan provider is taking.

Facts About Hard Money Atlanta Uncovered

Every one of that adds up here to indicate that a difficult cash financing can be an expensive means to borrow cash. hard money atlanta. Choosing whether to obtain a hard cash finance depends in large component on your circumstance. All the same, make certain you weigh the threats and the prices before you join the populated line for a difficult cash funding.You certainly don't desire to lose the finance's collateral since you weren't able to maintain up with the monthly repayments. Along with losing the possession you place click here for more info forward as collateral, back-pedaling a tough money lending can cause major credit rating damage. Both of these end results will certainly leave you worse off monetarily than you were in the very first placeand might make it a lot harder to obtain again.

The Only Guide for Hard Money Atlanta

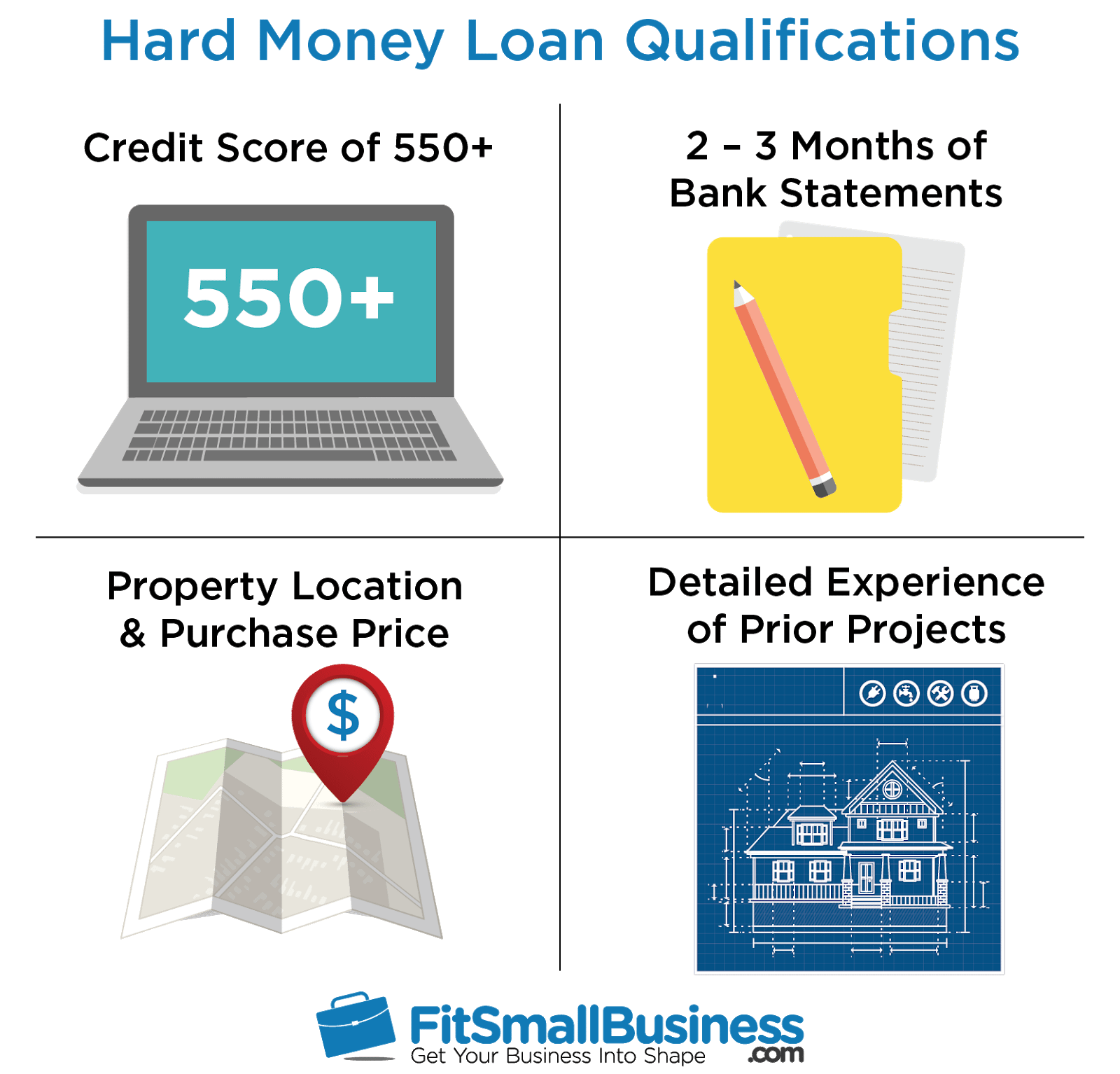

It is very important to take into consideration elements such as the lender's online reputation as well as rates of interest. You might ask a relied on property representative or a fellow house fin for recommendations. As soon as you've toenailed down the ideal tough cash lender, be prepared to: Think of the down repayment, which typically try this is heftier than the down settlement for a conventional home mortgage Collect the needed paperwork, such as proof of revenue Possibly employ a lawyer to go over the terms of the finance after you've been accepted Map out a strategy for repaying the lending Simply as with any car loan, assess the advantages and disadvantages of a tough money funding prior to you commit to borrowing.No matter what kind of lending you choose, it's possibly a good idea to inspect your totally free credit report and also cost-free credit rating record with Experian to see where your funds stand.

When you listen to words "hard money finance" (or "exclusive cash finance") what's the very first point that undergoes your mind? Shady-looking lending institutions that perform their organization in dark streets and cost sky-high rate of interest? In prior years, some bad apples tainted the hard cash offering sector when a few predatory lenders were attempting to "loan-to-own", offering extremely dangerous fundings to debtors utilizing genuine estate as collateral as well as intending to foreclose on the homes.

Report this wiki page